SMS Campaign Registration: Incorrect Tax Info Causes Brand Rejection

Symptom

There are a number of possible reasons that the SMS > Your Brand form submission in 8x8 Admin Console can be rejected.

This article addresses issues with submission of incorrect business tax information in the required Your Brand form.

Applies To

- SMS Campaign Registration

- 8x8 Admin Console

- Your Brand

Cause

One of the most common reasons for Brand verification to be rejected is due to incorrect matching of a combination of the following fields:

- Business Name

- Business Type

- EIN

- Address

Note: When submitting the Your Brand form, validation happens behind the scenes via The Campaign Registry and the IRS. 8x8 only passes the provided information on, so we cannot perform corrections to any of the submitted info.

Resolution

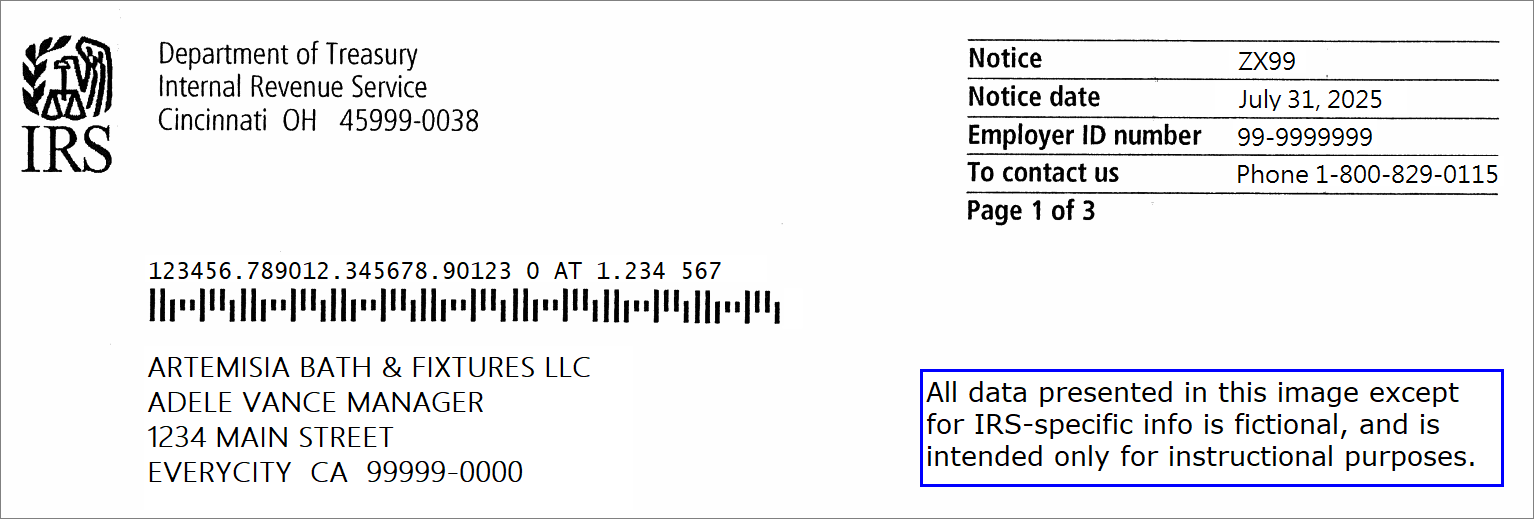

If your business is struggling to pass the Brand verification, please locate your business EIN/Tax ID confirmation document from the IRS/Government agencies, and make sure to correctly match everything when completing the Your Brand form.

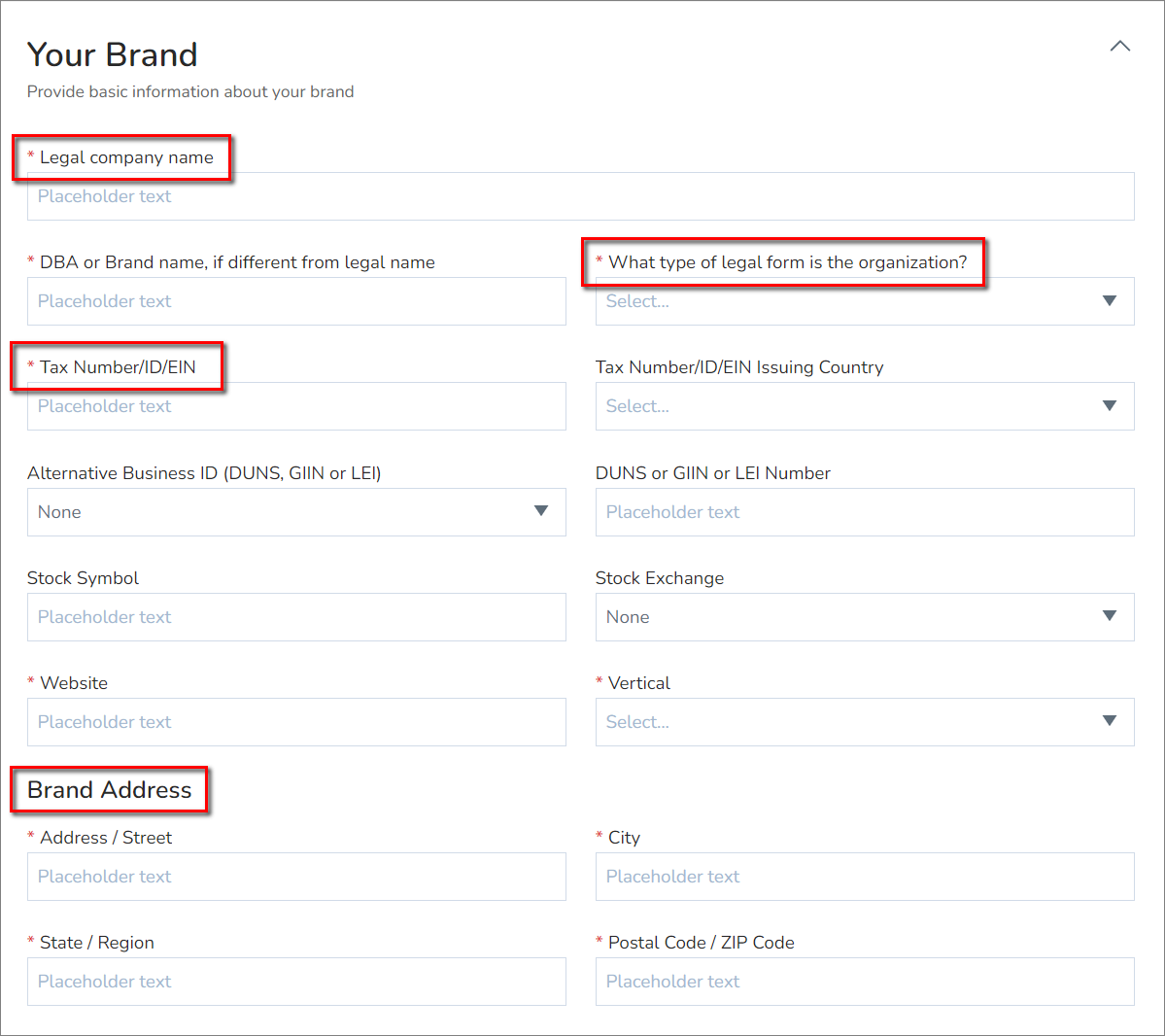

As an example, the image below shows how each piece of information would need to be entered into the Your Brand registration page:

- Legal company name: Artemisia Bath & Fixtures LLC Adele Vance Manager

- Tax Number/ID/EIN: 999999999

- Brand Address: 1234 Main Street Everycity CA 99999-0000

Common Mistakes

- Company Name: The most common mistakes happen with the legal company name, since everything above the address (as shown above) is considered part of your business name. It’s common to leave out the second portion of it, if one exists.

- Business Address: Another common mistake is in how the business address is entered. Minor formatting changes such as replacing the word Street with ST can cause verification to fail.

Canadian Customers

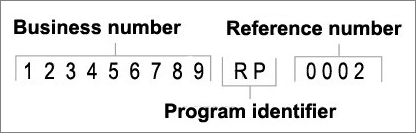

UPDATED 2023-07-20: The Campaign Registry (TCR) has updated their brand validation rules to accept only BN numbers for Canadian business. Please see below.

In order to validate a Canadian business, you must enter the Canadian Business Number (BN) into the Tax Number/ID/EIN field of the Your Brand form. For Brand validation purposes, you only need the first 9 numerical parts of the BN ID.

For example, if your BN is 123456789 RP 0001 you only need to input the Business Number 123456789. Please do not include either the 2-letter Program Identifier or the 4-digit Reference Number.

Canada Government and Non-Profit Society

The only Canadian non-profits that should register using the “Nonprofit” entity type are charitable organizations registered with and recognized as a 501(c) organization by the US IRS. Such organizations must submit their US EIN and specify “Tax ID Country” as “US.” Canadian Government entities and Non-Profit Societies must be submitted using the “Private Profit” entity type and will require External Vetting as there is currently no automated path to verify them.

Legal Name:

Please ensure that the legal name you submit matches the name associated with the identification number you provide.

Non-US Entities

For non-US entities, you'll need to look at the country equivalent of the IRS document mentioned above, and match your business information in a similar manner.

What should I do if my Brand submission fails, but the information I submitted is 100% correct?

In this case, please reach out to 8x8 Support and provide a copy of your IRS EIN confirmation documentation as proof. We can then apply for additional vetting in The Campaign Registry.